Understanding the Basics of Will and Estate Planning: A Comprehensive Guide

Planning for the future is an essential aspect of financial management and personal responsibility. Among the many considerations, will and estate planning stand out as crucial steps in ensuring that your assets are distributed according to your wishes after you pass away. While contemplating mortality might be uncomfortable, having a solid plan in place can provide peace of mind and alleviate potential stress for your loved ones. In this article, we’ll delve into the basics of will and estate planning, discussing what they entail and why they are essential.

What is Will and Estate Planning? Will and estate planning involve the process of arranging for the management and distribution of your assets after your death. A will, often referred to as a last will and testament, is a legal document that outlines your wishes regarding the distribution of your property and the care of any minor children. Estate planning, on the other hand, encompasses a broader range of strategies aimed at managing your assets during your lifetime and distributing them efficiently upon your death. This may involve tools such as trusts, powers of attorney, and advanced healthcare directives.

Why is it Important? Effective will and estate planning serve several crucial purposes:

- Asset Distribution: A will allows you to specify how your assets should be distributed among your heirs and beneficiaries. Without a will, state laws (intestacy laws) will dictate how your property is distributed, which may not align with your wishes.

- Guardianship: If you have minor children, a will enables you to designate a guardian to care for them in the event of your death. This ensures that your children are cared for by someone you trust.

- Minimize Conflict: Clear instructions provided in a will can help minimize disputes among family members and reduce the likelihood of litigation over your estate.

- Tax Efficiency: Estate planning strategies can help minimize estate taxes and ensure that your assets are passed on to your heirs as efficiently as possible.

- Peace of Mind: Having a comprehensive will and estate plan in place can provide peace of mind, knowing that your affairs are in order and your loved ones will be taken care of according to your wishes.

Key Components of Will and Estate Planning: When creating a will and estate plan, there are several key components to consider:

- Will: A legally binding document that outlines how your assets should be distributed and who should oversee the process (executor). It also allows you to name guardians for minor children and specify any final wishes, such as funeral arrangements.

- Trusts: Trusts are legal arrangements that allow you to transfer assets to a trustee who manages them on behalf of your beneficiaries. Trusts can provide flexibility, privacy, and control over asset distribution, particularly for complex estates or when minor children are involved.

- Powers of Attorney: A power of attorney grants someone the authority to make financial or medical decisions on your behalf if you become incapacitated. It’s essential to designate trusted individuals to act as your attorney-in-fact for financial matters and healthcare decisions.

- Beneficiary Designations: Certain assets, such as life insurance policies, retirement accounts, and bank accounts, pass directly to named beneficiaries outside of probate. Ensuring that beneficiary designations are up-to-date is an essential aspect of estate planning.

- Advance Healthcare Directives: These documents, such as a living will or healthcare proxy, outline your wishes regarding medical treatment and end-of-life care if you are unable to communicate your preferences.

- Regular Review and Updates: Estate planning is not a one-time event. It’s essential to review and update your will and estate plan regularly, especially after significant life events such as marriage, divorce, birth of children, or changes in financial circumstances.

Will and estate planning are vital components of responsible financial management and ensuring that your wishes are carried out after your death. By taking the time to create a comprehensive plan, you can minimize potential conflicts, provide for your loved ones, and achieve peace of mind knowing that your affairs are in order. Consulting with legal and financial professionals can help ensure that your will and estate plan are tailored to your specific needs and circumstances. Remember, it’s never too early to start planning for the future.

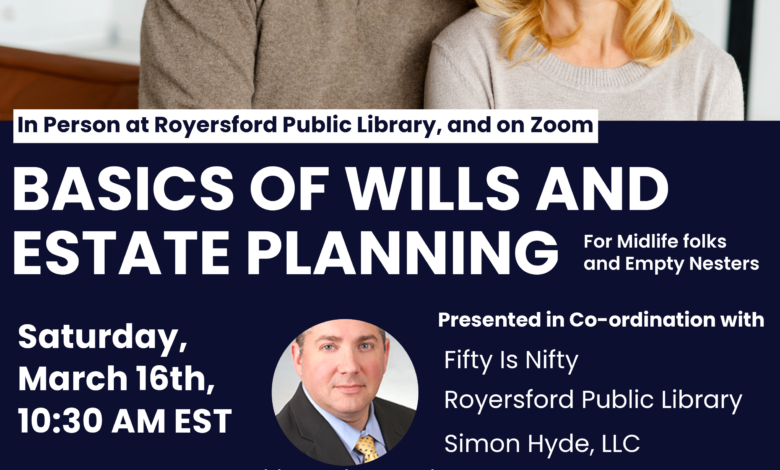

Join us for a FREE informational session on March 16th, 2024 at 10:30 AM.

The session is full now.